Blockchain has become one of the most often mentioned technologies in the past few years. It is best known as the technology that underpins Bitcoin, but it has many other use cases. It is also often followed by myths and misconceptions. In this guide, we will give a detailed explanation of everything you wanted to know about blockchain.

What is Blockchain?

A blockchain is a type of database, or a collection of information, stored in so-called blocks connected through complex cryptographic protocols. These make it almost impossible to compromise the data stored on the blockchain. This is because any changes to one block immediately corrupt the data in other blocks, so it’s obvious that someone has tried to change something. This makes blockchain tamper-evident. Previously recorded data can be updated but not retroactively changed. This means that all information can be traced thanks to a timestamp, checked again at any point, and can serve as a sort of digital fingerprint.

Blockchain has some other specifics that set it apart from other, more traditional databases. These are often considered the three pillars of blockchain.

The Pillars of Blockchain

Blockchain has three main characteristics:

- Immutability

- Decentralization

- Transparency

These are the foundations of blockchain itself, but also the things that guarantee cryptocurrencies built with blockchains are safe. It is safe to say that you can’t really understand blockchain technology without understanding these principles. Let’s take a look at each of them.

1. Immutability

Immutability means that something cannot be changed once it has been created. This is the property of a block added to the blockchain: once it is part of the system, it cannot be modified further.

Immutability in the blockchain is achieved through a process called hashing. Hashing takes some data and gives a certain output called a checksum. Every time you hash the same data using the same algorithm, you will get the same result, which serves as a digital signature. The biggest advantage of hashing is that it cannot be reverse-engineered: you can’t take a hash and get the information used to produce that hash.

In a blockchain, the hash is produced using both the information from the block currently in use and the previous block in the chain. This links them together: if someone tries to change the data in one block, all the hashes change, making data in all other blocks unusable. Since the hashes aren’t valid anymore, the blockchain rejects the attempted change.

In other words, this guarantees data integrity. You can always refer to information stored on the blockchain because you know it wasn’t changed in the meantime. Of course, information can be updated, but this is added to a new block. This ensures that you can trace its history reliably and serves as fraud prevention. Additionally, it can serve as proof of fraud: it can prove who did what and when it can serve as an impartial source of information. Of course, just because some information is on the blockchain doesn’t mean it’s true—but in this case, someone who made a mistake can’t cover their tracks.

But can the owner of the blockchain cover their tracks if they want? Well, no. This brings us to the next important aspect of blockchain.

2. Decentralization

Decentralization is the transfer of authority and responsibility from a single, central authority to all participants. In a blockchain, this means that nobody can act as the boss of anyone else. Every participant is on equal footing with others.

Of course, this is not so easily implemented in the real world. There are important considerations, such as the ability of people to create several identities to increase their decision-making abilities. This is actually a well-known manipulation tactic called a Sybil attack. To evade such possibilities, as well as let people maintain their privacy to a certain degree, the amount of power you wield in a blockchain network depends on other factors. These vary by consensus algorithm: in Bitcoin, it depends on your computational power, but on others like Cardano or Ethereum 2.0, it depends on the number of coins you hold.

There are several benefits to decentralization:

- Peer-to-peer communication: there are no intermediaries in a decentralized system. If you want to send someone money through the Bitcoin network, you do so directly, instead of through a third party like in the case of banks and other centralized financial services.

- Security: since the data isn’t stored in a single spot but is instead shared among all participants, you can’t really hack a blockchain.

- Data reconciliation: with all the data in one place and distributed among participants, any incorrect data (either through an honest mistake or as a malicious attempt) can be quickly recognized and corrected.

- Efficiency: if one node, or participant, has to update their system, or their power has gone out, the network can still go on as usual. This is because it does not depend on one person or even a group of people.

- Trustlessness: thanks to all the previous factors, as well as blockchain’s immutability, you don’t have to know anyone else in the network to know it will function well.

These benefits fit into each other and create blockchain’s famous environment that strives for fairness and equality.

3. Transparency

The fact that everything is stored on the blockchain as it is and cannot be tampered with would not mean a lot of that data was not visible to everyone. This is why transparency is the third pillar of the technology: anyone can see every transaction and all related information through so-called block explorers.

However, this does not mean that this information can be easily traced back to the individual or company responsible for it. You are not obligated to share your personal information with anyone when you use Bitcoin, for example (cryptocurrency exchanges are a different beast). You get assigned a wallet with its own address, and that address is the information stored in the block when you transfer funds to and from the wallet.

But “hard to trace” does not mean impossible. Many companies that use blockchain, for example, exchanges, keep their wallet addresses public so you can see their transactions. This is an important aspect, as it adds a level of accountability that was almost unheard of before blockchain.

Something similar is true for individuals as well. If you’ve gone through the Know-Your-Customer (KYC) process to register at an exchange, your wallet address at the exchange will be tied to your name and other information. This information will still not be visible on the blockchain itself. Still, it may be obtainable from the exchange, either as part of a regulatory process (for example, if you’re suspected of malicious acts) or through hacks and other breaches.

How Does Blockchain Work?

Understanding the pillars of blockchain helps understand how the technology works. We’ve already established that it is a transparent, immutable, and decentralized database. All participants have access to it, which makes it distributed. So when you want to make a change, for example, send some BTC to a friend, the following happens:

- You create a transaction. You add all the relevant information like who receives the BTC and how much.

- You pay the network fee. This is part of the miners’ reward for including your transaction in the next block.

- Your transaction is added to a block. This block is created by the participant who won the right to do so, depending on the consensus algorithm (miners, validators, etc.). The bigger your network fee, the more likely you are to be included before others, so your transaction might go through faster.

- The block is added to the blockchain. It goes through the aforementioned hashing process first. Once the block is added, you can’t change it anymore (which also means you can’t reverse your transaction unless the recipient decides to send you your funds back).

The process of adding a block to the blockchain depends on another factor called a consensus algorithm. They are used to decide which participant gets to add the next block (and receive the rewards). There are several different consensus algorithms, but two of the most common ones are:

- Proof of Work (PoW): used by Bitcoin, it involves solving a puzzle (also known as “mining”), and the first participant or miner to solve the puzzle and let everyone else know is the one who adds the block and receives the reward.

- Proof of Stake (PoS): used by the upcoming version of Ethereum, the participants who get to make decisions are known as validators and chosen by the number of coins they hold. Validators must stake a portion of the coins they own to be chosen to add a block and receive the reward, and if they try to act maliciously, they forfeit their stake.

A participant in the network is also called a node. There are three main types of nodes:

- Light Clients keep only a shallow copy of the blockchain, which includes only the basic information that they might need, as the blockchain itself tends to get very big;

- Full Nodes are those that keep a full copy of the blockchain and thus have access to all the information stored on it, regardless of size; and

- Miners or Validators are nodes that can get the right to verify transactions, depending on the network’s consensus mechanism.

Who Invented Blockchain

But where did blockchain come from?

The first blockchain launched in 2009 as the technology underpinning Bitcoin, made by a person or group of people under Satoshi Nakamoto’s name. However, it was first outlined almost two decades earlier by researchers Stuart Haber and W. Scott Stornetta in 1991. During the next 18 years, other technological innovations (such as the theory of cryptographically secured chains by Stefan Konst from 2000) made it possible for blockchain to get its first real-world implementation.

It is considered that blockchain separated from Bitcoin in 2014, and from then on, the technology is sometimes referred to as blockchain 2.0. This means that it is used for purposes other than Bitcoin from that time on, first starting with other cryptocurrencies and then moving on to other use cases.

Public vs Private Blockchains

All the properties we covered throughout this guide are specific to so-called public blockchains. These blockchains are also permissionless, meaning that anyone can become any node they want without fear of censorship, as there is simply no authority to forbid this.

However, with the ascent of blockchain 2.0, some enterprises needed to use the technology for their own purposes. In most cases, there is no reason why the data stored on the company’s blockchain should be publicly visible. This is where so-called private blockchains come from.

As their name implies, private blockchains are not available to everyone. They are usually reserved for the company and its partners. For example, in the supply chain industry, only people who are somehow tied to the cargo being tracked will access the blockchain. There is simply no need for the general public to access that blockchain and the information stored within, especially as it can be sensitive and should be protected.

Most private blockchains are also permissioned. In other words, an authority (usually the boss of the company) can set who can make changes to the blockchain and who can only read the recorded data. Very often, these blockchains are not decentralized simply because they don’t need to be.

How to Invest in Blockchain Technology

There are two main ways to invest in blockchain technology:

- Through cryptocurrencies: buying cryptocurrencies means participating in the blockchain. When the blockchain network introduces a new concept, improvement, or other significant change, its coin price often follows. Not only can you generate an income this way, but owning decent amounts of certain cryptocurrencies also gives you voting rights in the blockchain. This is not dissimilar to owning stocks.

- Through stocks: speaking of which, you can also invest in stocks of established companies that have blockchain solutions as part of their offer. These are often lower-risk options. You can also invest in blockchain startups that have gone public.

Other ways to invest in blockchain include participating in crowdfunding (ICOs and IEOs), blockchain penny stocks, and venture funds. The type you choose will depend on your own openness to risk and the number of funds you’re willing to part with.

How to Use Blockchain

When it comes to using blockchain for cryptocurrencies, the process is pretty straightforward. All you need to do is get the address you’re sending your funds to, enter it into your wallet’s Send option, set the network fee you want to pay, and wait for confirmation. Receiving funds is even easier, as you don’t have to do anything.

To use blockchain to trace information stored on it, you will need access to the blockchain’s block explorer. The most widely used block explorer for Bitcoin is Blockstream.info, while for Ethereum, people go with Etherscan.io. The latter is also used for all coins built upon the Ethereum network, making it a one-stop-shop for all things Ethereum.

Using blockchain to become a decision-making participant will depend on the type of blockchain. For PoW-based blockchains, you will need to own mining hardware and be willing to cover high electricity costs. In PoS networks, you will have to own a decent amount of the network’s native token and be willing to stake at least a part of it. For more in-depth information, check the network’s documentation, as this tends to explain everything you need to know in detail.

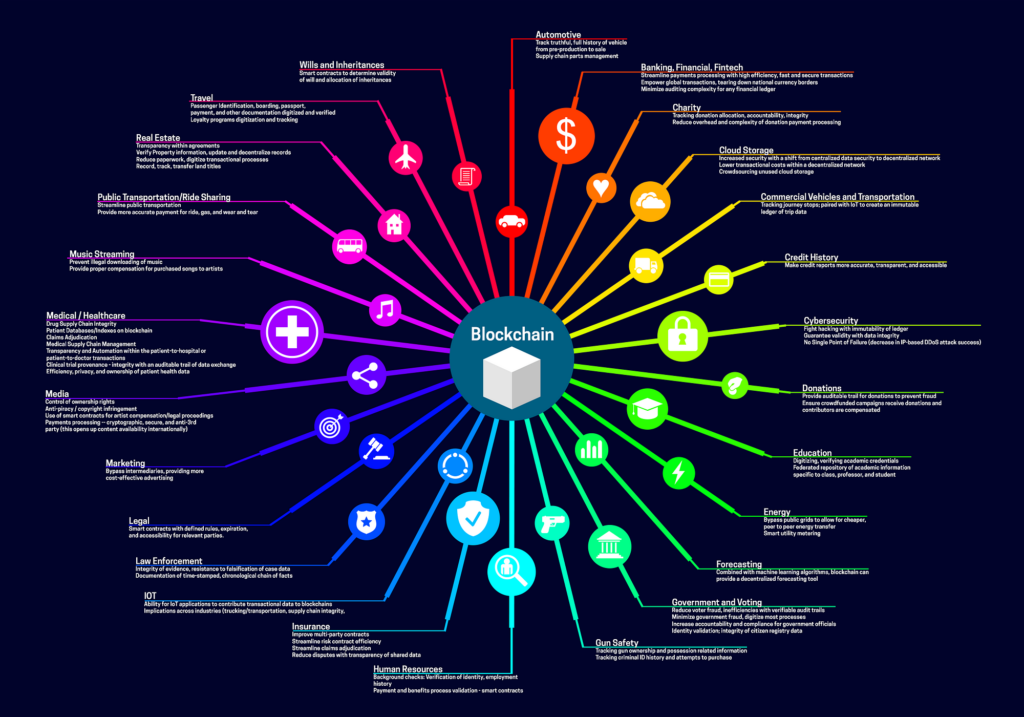

Blockchain Use Cases

Blockchain is nowadays used across many industries. The main similarity they share is that they all benefit from blockchain’s properties like immutability and transparency. Here is how blockchain improves businesses in certain industries:

- Supply chain: suffering from long and heavy paper trails, the supply chain industry benefits from blockchain in that it removes the need for all participants to have their own copies of everything. With a single, immutable source of information, data reconciliation becomes much faster and removes the need for any unnecessary third parties.

- Insurance: another case in which data reconciliation is important, blockchain allows all participants to see what was done by whom. This prevents insurance fraud and speeds up all processes.

- Banking: blockchain allows for faster and more efficient cross-border payments but also adds a new layer of transparency and accountability to traditional finance. This is why many banks are looking into their own central bank digital currencies (CBDCs).

- Healthcare: the coronavirus pandemic has proven a need for accessible healthcare information. Using blockchain, users can decide who to share their information with, which includes vaccination status, whether or not they’ve had Covid, and if they are at risk—all information that can help them lead a more normal life, like go to concerts and events, if they’re healthy.

- Pharmacy: pharmaceuticals are often counterfeit and/or sold on black markets, which can be extremely dangerous. Being able to track an item from its production to the time it reaches the end-user can help prevent that, along with checking whether it is expired.

- Government: voter fraud is a globally widespread issue that blockchain can help combat. This is why many countries are looking into implementing a blockchain-based voter system that cannot be manipulated in favor of any party to facilitate a truly democratic process.

- Art: perhaps the best-known example are NFTs. To own an NFT is to be able to prove you own an original digital item—something like the difference between owning an original painting and only having a print of it.

- Gaming: similar to art, NFTs take ownership to a completely new level, so collecting games are thriving thanks to the technology.

This is not an exhaustive list of potential benefits, but it is a good starting point towards understanding what blockchain is good at.

Common Myths About Blockchain

Blockchain is followed by some pervasive myths perpetrated by a lack of understanding. Here, we will take a look at them and explain the truth.

- Bitcoin = blockchain. One of the most common myths assumes that Bitcoin and blockchain are one of the same. As we’ve already covered, the two originated together, but blockchain has since found many other use cases.

- Blockchain uses a lot of electricity. This is only true of PoW consensus algorithms; blockchains that use other consensus mechanisms do not spend more electricity than many other technologies.

- Blockchain is slow. While Bitcoin transactions are much slower than other fiat payment processors, this is due to its set block time. Many other blockchains are much faster, even able to process thousands of transactions per second.

- Blockchain isn’t mature enough for the mainstream. Many enterprises are already using blockchain—Forbes has an annual Blockchain 50 list, where businesses with a revenue of more than USD 1 billion per year are shown.

- All my transactions are publicly visible! While this is true, this does not mean it can be easily traced back to you if you take some basic privacy measures.

3 comments