Do we know what happens within the central banks and massive financial institutions that dictate our financial lives? Is there a recorded history of all their transactions that we can look up at will?

This doesn’t seem to be the case. We can’t simply go to any bank and ask for the recorded history of every financial decision the bank has made. How financial institutions operate is largely hidden from the average user. They are centralized, meaning that you must trust the authority, the bank, in this case, to be the medium that carries out financial transactions. Centralized authorities like banks are not required to disclose every tiny decision they make to the general public.

Is it possible that every financial transaction can be recorded forever, never to be changed or altered, for everyone to see in full disclosure? Maybe, maybe not. But with the astronomical growth of decentralized finance, this vision of a trustless financial world is inching closer to widespread adoption.

Bitcoin: The Beginning of Decentralized Finance (DeFi)

Though Bitcoin is technically a cryptocurrency and not a decentralized finance application, DeFi was made possible through the founding ideas that came from Bitcoin’s 2009 entrance onto the world stage.

Imagine if the entire money supply of a country operated on a transparent, decentralized blockchain. It would be a sight to see any government reveal exactly how it allocates the taxes that citizens pay towards the country’s infrastructure, military, education, science, and so forth, along with seeing how an entire economy spends its money, down to the last cent.

It may not be a coincidence that Bitcoin was invented in 2009, right after the Financial Crisis of 2007-2008. After trust in central authorities like governments, banks, and corporations waned, trust in their handling of money waned as well. Satoshi Nakamoto, Bitcoin’s mysterious creator, sought a technology that would change how the world engaged with currencies. Bitcoin wouldn’t need any central authority to function. It would function on its own protocol of math, cryptography, and code.

That was only the beginning. Distrust in traditional finance isn’t solely rooted in currency. Financial systems have other mechanisms like loans, index funds, derivatives, and insurance that some argue are better off under a decentralized protocol. Decentralized finance isn’t merely using assets to create a decentralized version of traditional finance mechanisms. Like how Bitcoin decentralized money, DeFi aims to decentralize the components that make up our financial world today.

Participating in DeFi

In our current centralized network, all of your personal information is out in the open when applying for a loan. To participate in the centralized financial ecosystem, a bank might consider your previous account statement, your credit score, your income, and if you ever filed for bankruptcy. Whatever personal details that a bank believes are noteworthy when judging your capability, the bank can use those details to prevent you from accessing certain financial tools. The bank is the centralized authority.

With decentralized finance, there is no central authority that dissects your privacy. Your capability to participate in the ecosystem solely depends on similar smart contract protocols that other network users use. In this way, it keeps your privacy intact. All you need are whatever assets the DeFi application, or Dapp, requires. There is no need for a middleman and piles of paperwork to process the loan that you need. It is recognized immediately on the blockchain, saving time and resources. Because they’re built on blockchain, certain DeFi protocols are arguably safer than banks. Banks haven’t adopted cryptography into their general ecosystem. Of course, since DeFi is fairly new, a few projects may be subject to hackers.

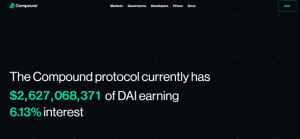

Other than the obvious perks of privacy and efficiency, Dapps allow you to take out decentralized loans from other investors like yourself. Since there is no central authority, other investors are the ones involved in a liquidity pool model. On Compound, for instance, investors pool their tokens and gain interest from borrowers of the pool. The interest rate is based on supply and demand. The lending pool will always be visible, so it’s clear if there are enough resources to borrow. The pool will lean towards being overcollateralized, making it so that there are still enough tokens left in the pool for loans to be borrowed.

Some of the fundamental characteristics of modern financial systems are lending and borrowing. These are central to everyday life. Loans are often taken out for things like a student’s education or to start a business. In traditional finance, you put up your car as collateral if you really need a loan. With decentralized finance, you can use a digital asset like Ethereum or a stablecoin like Dai if you need to borrow.

Like in traditional finance, collateralized debt positions or CDPs are coming to fruition. When you have an emergency in the centralized world, you turn to selling the car your dad gave you for your 21st birthday. In crypto, however, whatever you put in, you get 2/3rds of the collateral back, which might be off-putting for some. But if you’re in a pinch and need to liquidate your crypto quickly, this could be very useful. Your position won’t be liquidated if you leave it unless the value of the money you put in falls below the collateral you took out.

It’s surprisingly simple to get involved with DeFi. When you open a centralized bank account, you have to speak to a banker to activate your account and mail you a debit card. And when you do, it involves a process that needs all your private information and paperwork.

Instead of going through calls and meetings to set up a centralized bank account, where you’d on average be earning a 0.07% interest rate on already inflating fiat, Dapps allow you to open an account quickly where you’ll be presented with options in a decentralized space with far higher yields.

Getting involved in DeFi requires you to purchase cryptocurrencies, usually Ethereum (ETH). In some applications, you’re better off using stablecoins, coins backed by fiat currency like USD. Although it sounds counterintuitive for Dapps to use coins backed by fiat, oftentimes, cryptocurrencies like Ethereum can be volatile, and you need a stable asset to use for decentralized applications. More extensive use of stablecoins will allow the DeFi space to grow since it will lessen the stigma of volatility in what is supposed to be a decentralized mirror of our financial world.

One thing that DeFi users should hope for is good insurance for putting assets in DeFi. One thing that boosted the growth of stock markets during the 1800s was the implementation of limited liability. With limited liability, if you put your money in the stock market, you wouldn’t be liable if the company you invested in was found to have secret drug cartel operations. Similarly, for decentralized finance to grow, there should be a safety net to help ease users into space. Taking risks should be encouraged in any space that is just starting to grow. The more risks that are encouraged, the further the ecosystem will be pushed towards innovation with setbacks mitigated.

With privacy, efficiency, ease of access, DeFi has the potential to enable a vast amount of people to have access to financial tools which would otherwise be inaccessible to them. According to a study by The World Bank, 1.7 billion people in the world remain unbanked. A sizable group of people is cut off from what many consider a financial necessity. This alone shows that DeFi can become a technology that will aid people all over the world.

Risks of DeFi

Since the ecosystem is new, decentralized finance could seem complicated to someone who has just entered the space. If you’re not careful, you could lose your money quickly. It’s a simple task to hook up your Metamask to any DeFi application and begin accruing fees. If you have a sizable amount of crypto in your Metamask and hook it up to a DeFi application, be sure to pay attention to security. It helps to know about each protocol’s nuances before you trust them with significant amounts of money.

Until the Ethereum protocol fixes the high gas fees in the future, you might find yourself wondering if investing in DeFi is worth it. After all, Ethereum is the most used smart contract platform for decentralized applications, and you often have to pay over $100 for any transaction. This is where stablecoins swoop in to save the day. Until Vitalik and his team find a way to transfer ETH accessible to a person of normal means, stablecoins are where the less speculative types will take their DeFi curiosity.

One aspect of certain DeFi projects that might not sit well with some individuals is that they are closely linked to centralized financial institutions. It is centralized institutions that own some decentralized smart contracts. Binance trying to combine decentralized and centralized finance probably unnerved many purists who believe the old ways should be thoroughly cast aside.

All in all, decentralized finance should pique the interest of anyone who is itching to have our current centralized world transferred onto a blockchain. Who knows. Perhaps our financial futures will be encrypted onto networks upon networks of digital ledgers. And we’ll shrug as if it was always that way.

2 comments

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.