Often associated with risky ventures with crazy returns, yield farming has been generating quite a buzz. With Ethereum’s recent success, more and more users are wondering how to use their newly acquired cryptocurrency in order to generate even more returns. Crypto enthusiasts want to know the best possible way to get the most bang for their crypto buck. Many of them are now flocking towards yield farming.

Though the mechanics can be complicated, yield farming is, in essence, quite simple. Yield farming, to put it in very basic terms, is when your funds are stored and you gain rewards. These rewards are sometimes paid in dividends. Usually these rewards are high, and can even double your original input, but they come with high risk. You may double what you put in, but you lose half or more of that as well. However, there are strategies that are less risky and more sustainable.

Yield farmers often store their cryptocurrencies in several decentralized finance (DeFi) applications to generate yield. You can also move these funds around different applications and multiply your yield further. This is usually what people deem as the ‘farming’ aspect of yield farming. With the whole DeFi ecosystem multiplying to all-time highs this year, it has many wondering how to get the most return.

So why would anyone try yield farming? Simple. They do it to make a profit. The profits are usually high, making them attractive, even with the risky nature of yield farming. And plus, if you have a good amount of cryptocurrency lying in an exchange, it’s usually not doing too much. Using a DeFi application makes your crypto work for you as you’re holding it. They are also decentralized, making them private and fast. You don’t have to go to a bank, give all your Know-Your-Customer (KYC) information and wait for approval. You can just set up an account and start yield farming if you have the crypto.

Be careful when using some protocols. If you are unsure about a particular (DeFi) application, check to see its history and see if it’s fully audited. If at any point you suspect any foul play, you should pull your funds out. In any case, it’s best advised to carefully monitor your funds.

Yield Farming vs. Staking

You might be wondering, ‘isn’t storing my funds and gaining rewards just like staking?’ True, in staking you do lock up your funds and earn rewards from that. However, there is a fundamental difference. With staking, you are using your resources in support of a particular blockchain. Through yield farming, you are just focused on creating the maximum returns possible for the crypto that you lock up.

Also, yield farming is only one component of decentralized finance. While you can stake crypto in support of a decentralized application, that doesn’t necessarily mean that you are engaging in decentralized finance. DeFi attempts to mirror the traditional, centralized financial world, like lending, borrowing, annual percentage yield and so on, applying all these to the decentralized financial world. If you use these DeFi methods to generate more crypto with crypto, you are yield farming.

If you stake USD 1000 to support an upcoming blockchain project or altcoin, with rewards returned to you, this isn’t yield farming. You are supporting that crypto and earning rewards. You are not using the application itself to generate yield. However, if you use a decentralized application (dapp) that mirrors the traditional financial world and that dapp generates you cryptocurrency, you are doing a basic yield farming strategy. If you lock it up like a savings account, and gain annual percentage yield, that is yield farming. Though the term is usually associated with more complicated mechanics, this is yield farming at its most basic.

Yield farming could be a decentralized finance strategy of the future, so it’s good to become acquainted with it if you’re the type of person who likes to strategize your earnings. It’s common for yield farmers to move their funds around different platforms in order to generate the most yields. This would be called a ‘crop rotation’. If you’ve amassed a decent amount of crypto and want to earn more with it, yield farming could be your way of multiplying crypto earnings.

With most yield farming tools prevalent on the Ethereum blockchain, and Ethereum hitting unprecedented levels, yield farming applications like Compound and MakerDao have never been more prevalent. Once gas fees are resolved on the Ethereum blockchain or if decentralized finance applications on other blockchains become widespread, then yield farming might become closer to widespread usability as a regular savings in a traditional bank.

While a regular savings account may generate you 0.1% on the year of APY, annual percentage yield, as the extra money in interest that you will get when leaving money in a savings account, yield farming could generate you up to perhaps 6-30%, sometimes even 100%, by being a contributor or shifting your funds around.

Liquidity Pools

Perhaps the most straightforward way you see yield farming is through liquidity pools. This is commonly seen in Uniswap and other decentralized exchanges that are derived from Uniswap, like SushiSwap, since the code is open source. Liquidity pools are a fairly simple concept on the surface level. They are large amounts of cryptocurrencies pooled together by those willing to put their crypto onto it. These cryptocurrencies are what allow decentralized exchanges to have token pairs that you can exchange, like Ethereum (ETH) / Chainlink (LINK) for example.

What do you get if you add to this pool? You get a return on your investment. With Uniswap, every time you use the pair, those who put money into the pool will receive interest from the funds borrowed. The pairs are the same exact amount in value. For example, if you contribute Ethereum (ETH) and Chainlink (LINK) as a pair in Uniswap, you will gain a reward every time that pair is used.

There is a 0.3% fee for users when swapping tokens. This 0.3% fee is divided among liquidity pool providers in proportion to what they put in. On other pools, like SushiSwap, the rewards might be different. Liquidity pool providers have a multitude of options to see what best fits them. This leads DeFi users to choose different decentralized exchanges to contribute liquidity pool funds towards those that are in closer alignment to their goals. To some who don’t have high funds, they may choose a provider like SushiSwap over Uniswap, since SushiSwap has a reward system that might be more beneficial to some who don’t have as much to stake.

What are these pools used for? If you are ever on a decentralized exchange (DEX) and want to swap out two tokens, like Ethereum (ETH) for Chainlink (LINK), you are using funds from the pool. This is a solution to the buy and sell model of centralized exchanges. Instead of an exchange that is the custodian for your funds, you are instead using a peer-to-peer model. In a traditional stock market exchange, you have the exchange act as a custodian to find a buyer for the stock you are selling. Decentralized exchanges work with automated market makers. It uses smart contracts, protocols based on math and code, in order to execute these exchanges. Banks are central authorities

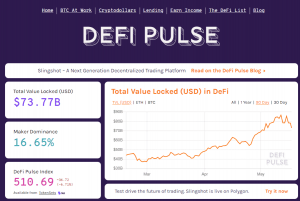

To see the total value locked in an application, you can use DeFi pulse. The term total value locked (TVL) is a measure of the total amount of funds that are locked in DeFi marketplaces. These also give a gauge on the amount of contributed cryptocurrencies in liquidity pools of various DeFi applications.

Compound

Liquidity pools are the simplest version of yield farming. However, yield farming gets its reputation from using investment rewards and investing those rewards again into varying liquidity pools. Each liquidity pool has its own reward token that the liquidity provider receives upon giving funds.

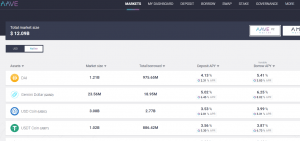

Here we will be using Compound as an example. Although several applications like Aave and MakerDao can exceed Compound in TVL, Compound was one of the protocols where yield farming really exploded. The fact that you can get compound tokens when contributing funds really made it attractive.

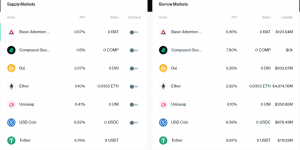

Using Compound, you can contribute tokens for high yields, like 6.96% APY for basic attention token or 8.58% for USDC.

You can put in stablecoins as collateral like DAI in Compound and other DeFi applications to generate high yields. You can then take out a loan using what you’ve put as collateral to switch to tokens on other platforms and reinvest them. For example, in the above chart, you can put in $2000 of Ether (ETH), to keep it simple, and are able to take out a loan of that for up to 60% of its value in the same or another token, let’s say $1200 of Tether for instance. You can then use that loan to swap to another DeFi protocol to ETH. And, assuming that the price is favorable, you can put your loan back into Compound with a slight gain, to ‘farm’ for even more yield.

This is just an example and not financial advice. It is always recommended to talk with a financial advisor before pursuing financial risks.

Using the website DeFi rate, you can check every loan to see where you can reallocate your funds. It is an aggregator used for those who want to see a coin’s value compared to other markets.

There are high risks of course, since cryptocurrencies like ETH are very volatile. This is something you should keep in mind when thinking about yield farming. Also, be aware of the gas fees of whatever blockchain you’re using.

For complicated forms of yield farming, you may also want to consider ones that are tied to stablecoins like Dai (DAI) or USD Tether (USDT) that are backed by the US dollar (USD). Why? Cryptocurrency, for now, is often a volatile marketplace. Using a stablecoin that is backed by USD makes it clearer for the yield farmer to know exactly how much is being yielded.

For example, if you are familiar with USD, then taking USD out of an account is more measurable for you than the price of a cryptocurrency. Taking out 1000 USD is far easier to imagine than taking out 1 Ethereum, since the value of Ethereum can change on a moment’s notice. 1 Ethereum can swing to USD 1250 one day and then USD 1100 another day, making it more complicated for the yield farmer.

There are many applications like MakerDao, Synthetic, Aave, Balancer and others that allow a whole range of complicated strategies. Decentralized Finance can be just as deep of a rabbit hole as the traditional financial world.

Yield Farming Risks

Smart Contract Bugs -The advantage of an automated market maker is that it runs on code once conditions are met. Although the technology has gotten better over time, there is still a possibility of it being exploited

Liquidation – If your collateral has dropped below what you loan, there will be a penalty on your collateral. This could also happen if that value of your crypto drops.

Gas Fees – Be careful of putting money into anything on the Ethereum blockchain when the gas fees are high. A new protocol could soon change that. However, right now, the gas fees could be as much as your yield if you’re not putting amounts in the tens of thousands. However, you can contribute to liquidity pools that have lower gas fees or wait until Ethereum is manageable.