At the moment, there are over 2000 cryptocurrencies listed on different exchanges and growing. There is no way one could research all these projects. Yet, sooner or later, you may stumble into a great investment opportunity.

Knowing astronomical crypto returns, you may not want to pass it. However, buying lesser-known altcoins is more complicated and riskier than it appears. Fortunately, you came to the right place, as this guide shows you how to purchase altcoins safely in 2019.

What Are Altcoins?

The story of cryptocurrencies began with Bitcoin back in 2009. Ever since the genesis block, it has had the following set of parameters:

- There can be only 21 million Bitcoins.

- New coins are produced every 10 minutes.

- Bitcoin is mined and secured by enormous quantities of computing power.

- It is designed to be means of payment.

As you can see, Bitcoin has a predefined niche, parameters, and use case. But being the technological breakthrough that it is, the technology behind Bitcoin enables many more opportunities. In spite of being the first fully decentralized digital currency, it also paves the way for a diverse ecosystem of other projects and cryptocurrencies.

Many visionary entrepreneurs and technology pioneers perceive thousands of ways how distributed ledger technology (DLT) can revolutionize the way we live. And that is where altcoins come in.

By definition, altcoins are “alternative coins.” The term applies to literally all cryptocurrencies that are not Bitcoin. Popular altcoin examples include Ethereum, Litecoin, Ripple, Tron, Verge, EOS, and all others.

Many altcoins are just straight-out copies (forks) of Bitcoins’ open-source protocol. Others are merely cash-grab projects or failed experiments. Despite that, there also are many exciting ventures with unique value propositions, solutions, and characteristics. You just need to sort the wheat from the chaff.

Main Types of Coins

It is too easy to lose yourself in the ever-growing sea of crypto projects and startups. Let’s put crypto assets into five different categories to make things easier:

Digital Currencies

Digital currencies, also known as cryptocurrencies, digital coins, or currency tokens, are designed to facilitate quick and reliable peer-to-peer transactions. Bitcoin and number of alternatives fall under this category. If fact, many of them came to exist simply by modifying Bitcoin’s core code.

Such coins are Litecoin, Bitcoin Cash, Dash, Zcash, and many others. Other digital currencies are written from scratch. Coins like Monero, Bytecoin, Ripple, Stellar, Nano, and similar projects still serve the same goal, but use different approaches.

Utility Tokens

These are tokens that grant users specific rights, such as access to platform functions, services, and privileges. Alternately, they are called app coins. In most cases, utility tokens are issued on a specific blockchain or DLT platform (like Ethereum) and are distributed via Initial Coin Offerings (ICO’s). ICO’s are used to crowdfund project development.

ICO investors, in turn, receive platform tokens. Some projects allow the token holders to vote on important governance decisions or stake the tokens for bonus rewards. Few popular examples of utility tokens are Basic Attention Token (BAT), Golem (GNT), Status (SNT), Revain (R), Augur (REP).

Security Tokens

Security or equity tokens grant buyers a fraction of the project ownership. In some cases, they represent digital shares of a company and even pay dividends to the holders. However, many security token offerings were canceled due to regulatory constraints. Nevertheless, they are gaining increasingly more traction.

Investors like security tokens due to their benefits, while projects can take advantage of the investor’s funds. Also, note the difference between security tokens and tokenized securities. One is a security, explicitly issued on a distributed ledger, while the latter is just an on-chain representation of an existing asset.

There have been many heated debates about what actually constitutes a security token, and it is still sort of a grey area. For instance, The U.S. Securities and Exchange Commission (SEC) uses The Howey Test. According to the test, a security token must meet the following criteria:

- It is an investment of money (or other assets).

- The investment is in a common enterprise.

- There is an expectation of profit from the work of others.

When equity tokens are classified as securities, they become subjects to federal laws and regulations. Also, security tokens undergo a different issuance process called Security Token Offering (STO). Once issued, security tokens do not appear on regular cryptocurrency exchanges.

They are traded in specialized security token exchanges accessible only to accredited investors. The prime examples of tokenized securities are BCap (Blockchain Capital), Science Blockchain fund, and Lottery.com. Projects helping companies to launch STO’s are Polymath (POLY), Harbor, Securitize, and Swarm.

Asset Tokens

Asset tokens are backed by commodities like fiat currency, gold, oil, and others. They constitute a digital representation of underlying assets and derive value from them. As a result, most asset-backed tokens maintain a relatively stable price compared with regular cryptocurrencies Asset tokens introduce a novel way to utilize blockchain, and their market will likely continue to grow.

Essentially, they make it easier to purchase commodities without added logistics and transportation costs. Popular examples of asset-backed tokens are Tether (USDT), TrueUSD (TUSD) and Digix Gold Token (DGX).

Reward Tokens

Reward tokens are used to express users status within an ecosystem. Like utility tokens, they are used on specific platforms, but instead of buying them users collect them as rewards for active participation.

Usually, they are meant to incentivize users to complete tasks that power the ecosystem. Nonetheless, they can be sold for other currencies in the exchanges. A few interesting examples of reward tokens are Steem (STEEM), Lympo (LYM), BitDegree (BDG).

Some coins and tokens are too hard to categorize and fall into several categories. On top of that, there is a segment of cryptocurrencies which appear not to have any serious purpose at all. Such projects are often called “joke coins.”

Dogecoin. A meme-based cryptocurrency. Source: dilettantiquity / Flicker.

Joke Coins

Joke coins work like currencies, and, in some cases, act like reward tokens. They can be sent from person to person, and even traded for fiat, but most of them were created purely for fun with no intention to innovate.

Some of them are just get-rich-quick schemes without any value, so they are not good investments. Examples of joke coins include Dogecoin (DOGE), Kanye West (Coinye), PonziCoin (PONZI).

Main Types of Altcoins By Popularity

Some altcoins are easier to get than others. They are listed on numerous exchanges and are easy to acquire. For example, Litecoin (LTC) is listed on at least 150 trading platforms. Ripple (XRP) is listed on more than 110 exchanges. The most popular privacy coin Monero (XMR) can be found on more than 50 exchanges.

However, not all altcoins are that popular. Being listed on popular exchanges takes time, especially for new projects and their respective altcoins. Lesser-known coins are typically listed on just one or two questionable reputation exchanges, which makes the acquisition much more complicated. More often than not, you have to register on multiple exchanges to get specific, low-profile altcoins.

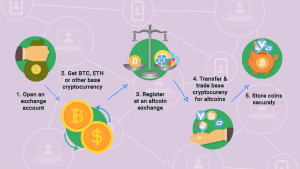

How to Buy Altcoins (and Where To Buy Altcoins)

There are many ways to buy altcoins from various exchanges, but which one suits you the best?

The most convenient way always depends on your situation. Do you already hold some cryptocurrency? Do you have an exchange account? Let’s go through the process of purchasing your first altcoins.

1. Choose a reputable fiat-to-crypto exchange

In most exchanges, altcoins are paired either with Bitcoin or Ethereum. You will need to trade them for altcoins. In some cases, you will need to register and transfer cryptocurrency between a few exchanges to get what you want. On the other hand, it is a relatively easy process and returns often outweigh the trouble. So if you don’t have any Bitcoins or Ether yet, let’s start at the very beginning.

First, you need to register at a gateway service. Gateway or fiat-to-crypto platforms are services where you can purchase cryptocurrencies with fiat. In our experience, one of the most beginner-friendly exchanges is Crypto.com exchange, which lets you buy, sell, trade cryptocurrencies and fund your account with ease. Besides, it comes with a handy Crypto.com app and debit card, which lets you pay for daily expenses with crypto.

Other reputable and beginner-friendly fiat-to-crypto platforms include

Coinbase , eToro , Binance , and few others.

Look for a service that suits your needs and is not blocked in your jurisdiction and pay attention to the deposit and transfer fees. Some gateway exchanges or brokers offer quick credit/debit card transfers, but it usually costs more than a regular transfer. Also, check what cryptocurrency markets they have. Most services always work on listing more cryptocurrencies, so if you are lucky, you might find a wanted altcoin listed on an accesible fiat-to-crypto platform. In that case, you should simply buy it there.

Here is a list of popular gateway exchanges and their fees compared:

| Exchange | Deposit fee (transfer/card) | Crypto withdrawal fee | |

|---|---|---|---|

| Coinbase | Free/3.99% | Network transaction fee* | |

| eToro | Free | Network transaction fee* | |

| Binance | Unavailable/3.5% or $10 | 0.0005 BTC/ Differs per currency | |

| Bitstamp | Free/5% | Free | |

| Kraken | Free or $5 for international | ฿0.0005/differs per currency |

Always strengthen your account security as soon as you register on a new exchange. You can do so by simply activating two-factor authentication.

2. Register And Buy Bitcoin or Ethereum

Now that you have chosen the most suitable exchange, it is time to get there, register an account and purchase Bitcoins or Ether (or altcoins, if they are listed there). Both Bitcoin and Ethereum are popular and widely accepted cryptocurrencies. They also have the most trading pairs, so swapping them for altcoins is easy and convenient.

Every reputable exchange has a thorough guide or extensive FAQ section to help you make first purchase, so it should not be too much trouble. You can find links to each of them below:

– Coinbase: How to Buy Bitcoin?

– eToro: Bitcoin Trading

– Binance: How Do I Get Started?

– Bistamp: How To Buy Bitcoin At Bistamp?

– Kraken: Trading Guide

3. (Optional) Register On Altcoin Exchange

If you can get the altcoins you want using a fiat-to-crypto exchange, your mission is accomplished. However, usually fiat-to-crypto exchanges have a very limited selection of altcoins, so what you seek may not be there. That is why there are many so-called altcoin (crypto-to-crypto) exchanges.

Altcoin or crypto-to-crypto exchanges are cryptocurrency markets that do not have fiat pairs and deposit options. Typically, those exchanges survive by listing less popular, fresh, and promising projects that come at a low price, but can significantly enrich investors pockets in the long run.

Here is a table comparing some of the most popular altcoin (crypto-to-crypto) exchanges.

| Exchange | Altcoin pairs | Trade fees | Security |

|---|---|---|---|

| HitBTC | 928 | 0.1% | Secure |

| Binance | 434 | 0.1% | Secure |

| Bittrex | 348 | 0.25% | Highly Secure |

| Poloniex | 146 | < 0.1%/0.2% | OK |

| Kucoin | 394 | 0.1% | Secure |

Pro tip: Use Coinmarketcap or alternative coin research platforms to find which exchanges have the markets that you seek.

Before choosing an altcoin exchange, pay attention to its reputation and security measures. Be wary of the platforms with a history of hacks or bad reviews. Crypto-to-crypto exchanges are mostly unregulated, so act with caution and never take risks that you cannot afford to lose.

Always strengthen your account security when register on a new exchange. You can do so by setting up two-factor authentication.

4. Transfer Coins From One Exchange To Another

After you have selected a suitable altcoin exchange, it is time to make a deposit. You do so by withdrawing your cryptoassets (most likely BTC or ETH) from your gateway (fiat-to-crypto) exchange wallet to the altcoin (crypto-to-crypto) exchange wallet. The process is simple and universal for all exchanges.

First, you need to find and copy the deposit address in the altcoin exchange. Make sure that your wallet address is for the asset you are about to deposit. For example, never send Ether to a Bitcoin address. If you are transferring Bitcoin, be sure to send it to a Bitcoin wallet address. This is a simple yet critical step! If you fail to do it right, you may lose your funds!

Next, head to the gateway exchange and navigate to withdraw section. Enter your altcoin exchange’s wallet address (double check if it is correct) and hit the withdraw button. In some exchanges, you will need to confirm the withdrawal using your email. The coins should arrive within minutes or an hour at most, based on how fast and congested is the network.

5. Buy Altcoins on a Chosen Altcoin Exchange

Here comes the fun part – getting your much-wanted altcoins. Once the deposit reaches your crypto-to-crypto exchange wallet, you can head to the market and trade your BTC or ETH for altcoins.

Be aware that purchasing low-key altcoins come with more risks than obtaining time-proven, widely acknowledged projects. Little-know coins with anonymous team members and too good to be true promises can turn out to be just elaborate scams.

6. Transfer Altcoins to a Hardware Wallet (Recommended)

If you are planning to leave your altcoins in the exchange wallet, the history of exchange hacks should not give you good nights’ sleep. Most exchanges are prime targets of hacker attacks because they keep lots of crypto in their wallets. Besides, exchanges have full control over your funds, so they actually do not belong to you until you store them in a private wallet. Hence the saying, “not your keys, not your Bitcoin.“

The safest way to store your altcoins is to use a hardware wallet. Yes, they do cost you a few extra bucks, but that is nothing compared with a complete sense of security. Ledger and Trezor make the most popular hardware wallets. Besides, they support a lot of altcoins. However, if none of them provide support to the altcoin(s) you hold, you can use the project’s native wallet.

How to Buy ICO Coins

Now that you know how to buy altcoins, you are more crypto-savvy than the majority of people in the world.

In addition to regular purchases, you may encounter initial coin offerings (ICO’s) or coins that are not yet listed on any exchanges. It does not necessarily mean it is a scam, but there are some rules you should know and follow.

When Is It Safe

There is no surefire way to identify a fraudulent ICO or coins. However, you can follow these tips when examining if it is a legitimate crowdsale:

- A safe ICO has transparent communication and requires you to pass KYC.

- The majority of team members are public, and their online presence confirms their involvement in the project.

- The team members have a good reputation and a profile of successful past projects.

- A valid project should have a realistic, obtainable goal and utility for their coin. They will try to do something completely different compared with traditional cryptocurrencies like Bitcoin or Ethereum.

What Are The Risks of Investing In An ICO

ICO’s and unlisted coins are considered to be the riskiest investments in the space. It is way easier to make promises than to deliver results. Most ICO’s raise the money for the sake of raising money and do not do anything more. Be careful of the unproven teams and people.

How To Buy ICO Coins

Despite the risks, ICO’s are a great way to become one of the first supporters a promising project. Besides, they can be immensely rewarding. In 2017 alone, an average ICO produced 1320% ROI. Of course, that is not the case with every project, but sometimes it can be worth the risk. Participating in the ICO is not tricky, too. Most of the ICO’s raise either Bitcoin, Ethereum, or other coins. In most cases, they will have a clearly defined documentation on how to contribute. It is very likely that you will need cryptocurrencies or even altcoins to participate.

If you are seriously interested in ICO’s, check out our comprehensive ICO guides for more in-depth information.

Hopefully, this guide has helped you will be able to support your favorite projects better. If so, let us know and share this guide with your friends.