CB Insights has unveiled the 8th edition of its AI 100 list, featuring the world’s 100 most promising private AI companies. These companies are making significant strides in tackling some of the most challenging issues across various industries with innovative AI solutions.. CB Insights is launching the 8th annual AI 100 — a ranking of the 100 most promising private AI companies in the world.

This year’s AI 100 highlights include:

- Representation from 16 countries, including the United States, France, and South Africa.

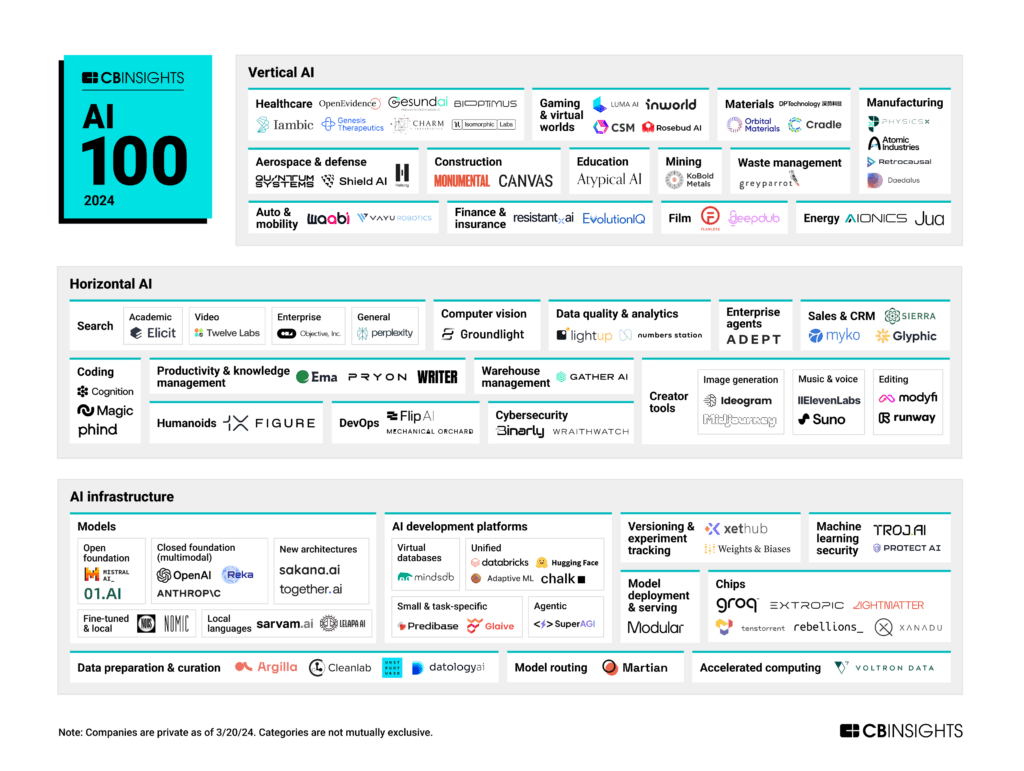

- Over 30 different categories of AI applications, ranging from foundational models to humanoid robots.

- A substantial portion of the list, 68%, comprises early-stage startups that are developing technologies for virtual environments, autonomous production facilities, and language models catering to under-represented languages, among other initiatives.

- Since 2016, these companies have established over 600 business connections with major industry leaders such as Toyota, Netflix, and the World Bank.

The selection process for this prestigious list involved a thorough analysis by CB Insights’ research team. They utilized a variety of data, including deal activity, industry partnerships, team composition, investor profiles, patent filings, and proprietary Mosaic Scores. Additionally, exclusive interviews with software purchasers and direct submissions of Analyst Briefings by startups were also considered in the evaluation.

Please click to enlarge.

CB Insights customers can interact with the entire AI 100 list here and view a detailed category breakdown using the Expert Collection.

2024 AI 100 COHORT HIGHLIGHTS

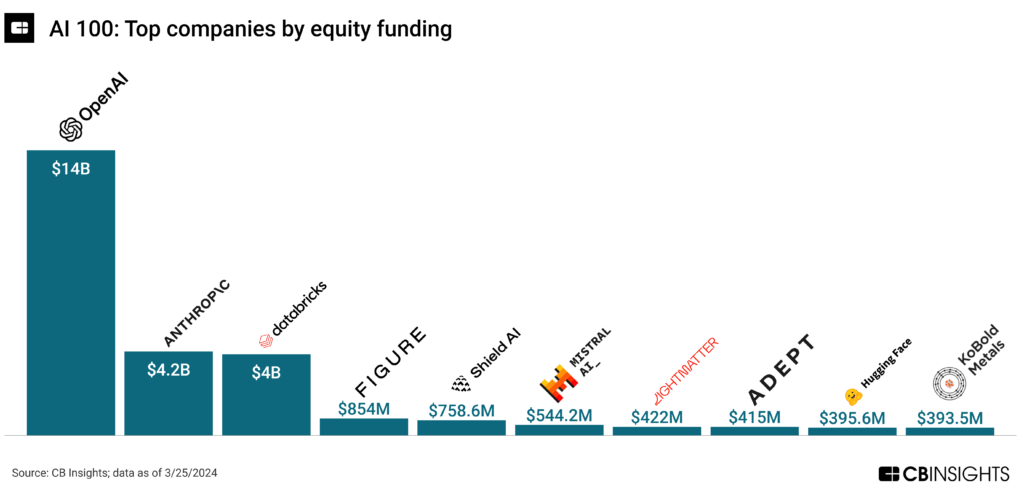

Funding distribution

The cohort has raised over $28B across 240+ equity deals since 2020 (as of 3/22/24). OpenAI has raised over 40% of that total, with $12B. Meanwhile, 25% of the winning companies have raised less than $10M, with some not having raised any venture funding.

Just over two-thirds (68%) of winning companies are in the early stages of fundraising (seed/angel and Series A) or have yet to raise outside equity.

Valuation trends

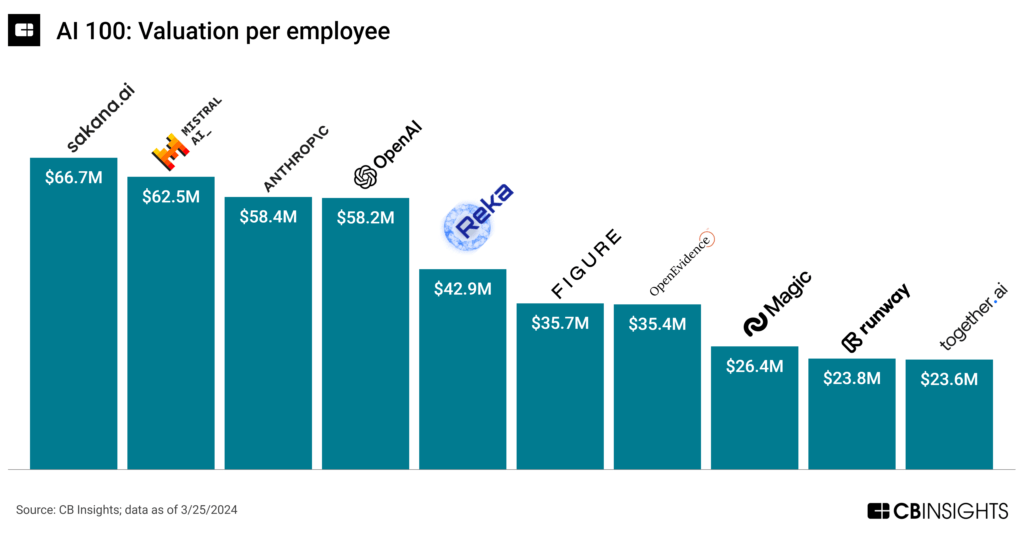

This year’s list includes 19 unicorns with a $1B+ valuation.

Meanwhile, Sakana AI — founded by one of the authors of the seminal Google research paper on Transformers — has the highest valuation per employee, at $67M. (It had just 3 employees when it earned its $200M valuation in early 2024.) Sakana is working on new “nature-inspired” AI architectures and recently released 3 Japanese-language models.

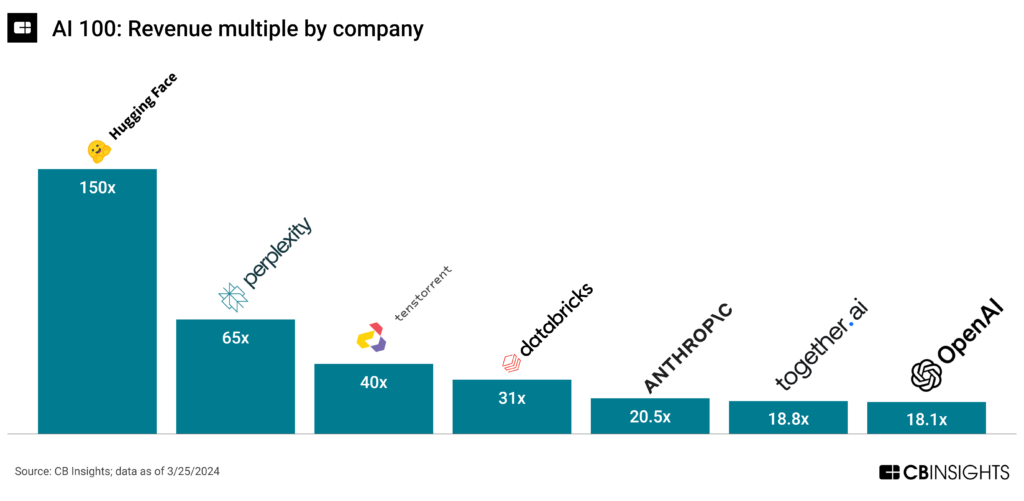

Revenue generation

The AI 100 includes a mix of companies at different stages of maturity, product development, and revenue.

Hugging Face, an AI infrastructure platform focused on open-source development, has one of the highest revenue multiples at 150x ($30M in 2023 revenue at a $4.5B valuation). It’s followed by Perplexity, which is developing an alternative to traditional search engines, at 65x (based on a 2023 valuation of $520M and $8M in 2024 ARR).

Midjourney, an image generation platform that has not raised any outside equity, is one of the leading AI 100 winners by revenue with $200M in ARR.

Global reach

A total of 31 winning companies in this year’s cohort are headquartered outside the United States, across 15 other countries. This includes South Africa-based Lelapa AI — which is developing language processing tools for sub-Saharan African languages like Afrikaans, isiZulu, and Sesotho — and Canada-based Ideogram, which is tackling the problem of generating images with legible text.

Europe-based startups account for 19% of the list, including companies headquartered in the United Kingdom, France, and Germany.

Categories & applications

Over one-third of this year’s winners are focused on building core AI infrastructure, from foundation models to AI chips to AI development platforms.

A total of 30 vendors are focused on horizontal (i.e., cross-industry) solutions like coding automation, creator tools, and search, while 34 companies are specializing in verticals like gaming, healthcare, education, and manufacturing.

A handful of winners are building niche applications where the use of AI is not yet commonplace. These include:

- Atomic Industries, which is developing AI for tool and die making in manufacturing and is backed by the venture arms of Porsche, Yamaha, and Toyota

- Rosebud AI, a text-to-game generation startup backed by OpenAI co-founders Ilya Sutskever and Andrej Karpathy, as well as Khosla Ventures

- Flawless AI, a startup developing lip-synced video dubbing for the film industry

15 comments

BWER is Iraq’s premier provider of industrial weighbridges, offering robust solutions to enhance efficiency, reduce downtime, and meet the evolving demands of modern industries.

imxg2i

646rtm

h4c7z2

l1TAgK6N94w

koufkn

7vgtwn

yvvjgg

Didn’t know iziswap had advanced tools to reduce IL—awesome!

Insolvency Practitioners

Polygon’s speed and low fees make it a DeFi favorite!

lb8chb

Rhino’s method of minting instead of wrapping is genius.

Thanks for making a complex topic actually easy to grasp.

his is the alpha I’ve been looking for—BRC-20 is heating up!